Use the endowment approach to build family wealth.

Paragon Investing provides our clients with access to high-caliber private market investments, the same funds owned by ultra-wealthy families and university endowments.

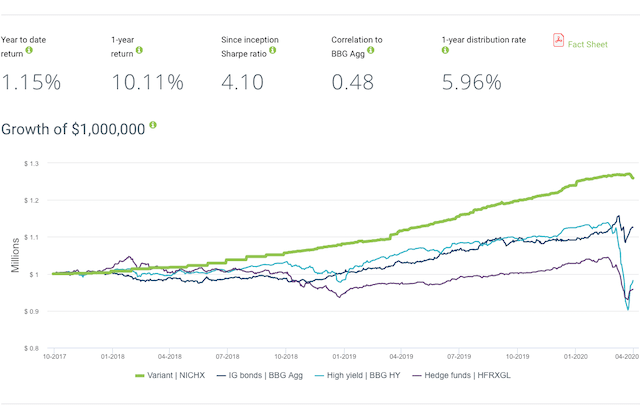

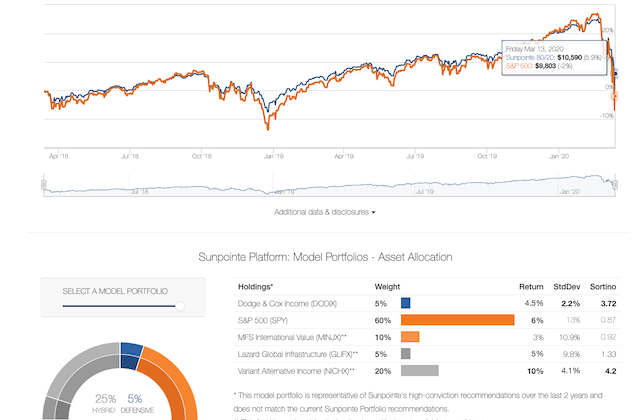

Since 2004, Private Equity has returned 14.7% annually (as of 12/31/2022), while Private Debt has returned 9.3% annually, each one outperforming their public market equivalent by +5.5% per year (Sources: Public Stocks: 9.2% [Russell 3000], Public Bonds: 3.0% [AGG], Private Equity: 14.7% [Cambridge Private Equity Index],Private Debt: 9.3% [CDLI]).

Five years ago, getting access to private investments was difficult. Most were only available via Limited Partnership (LP) deals with stated $1M minimums and extended lock-ups, not suitable for most investors with $1M-$10M in assets.

Today, Paragon clients can invest in Private Debt & Private Equity via interval funds and tender offer funds, with quarterly liquidity and no minimum investment (one fund has a $50k minimum).

You invest in what we're invested in. Paragon Advisors are invested alongside our clients in the same funds.

See How Private Investments Enhance Returns