Private Debt Generates Smooth Portfolio Returns

Paragon's Chief Investment Officer (CIO) has a 10+ year track record of designing portfolios for ultra-wealthy families and university endowments that seek to exceed the annual returns of the equivalent public benchmark with statistically less volatility and risk.

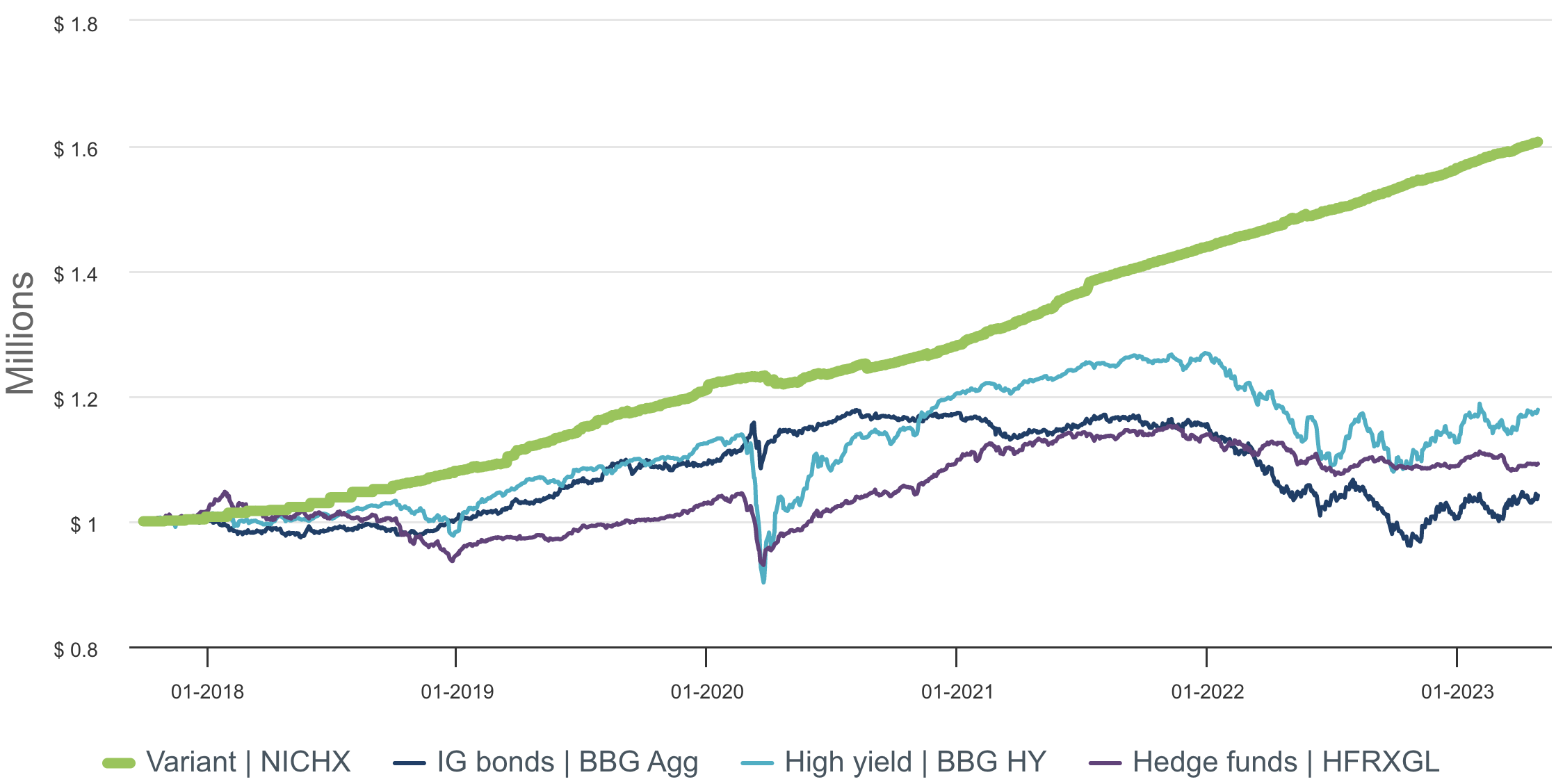

Orignal Source: Variant Investments Retrieved 6/2/2023.

How is Paragon different?

Paragon and its partners spend hundreds of hours researching and performing due diligence on restricted funds to establish high conviction in select private debt funds, like the one shown above. Private Debt as an asset class has historically outperformed traditional US Bonds by +6.3% annually (source) over the last 19 years (Cliffwater CLDI 2004-2023), and we strive to outperform the index with our manager selection.

This Paragon preferred fund is targeting returns of 8-11% annually, and has returned 57% cumulatively in its first 5 years since inception, for an annualized return of 9.5%. In addition to attractive returns, it offers lower risk as well. Private Debt interval funds doesn't have a large peak-to-through loss (max drawdown) like a typical high-yield bond fund. In March 2020, when public High-yield Bond funds were down -22% (BBG HY), our preferred fund was only down -1.8%. That's an additional 20% of your money.

Some of our preferred Private Debt funds are restricted to ultra-wealthy clients, and would normally require a $1M-$10M minimum investment, putting it out of reach for many individual investors.

At Paragon, we have partnered with key funds to provide access and minimum investments are only $50k because we have already met fund's $10M minimum. So you can responsibly invest $100k-$500k in our private debt funds and enjoy 8-11% expected returns with reduced volatility (relative to traditional Bonds).

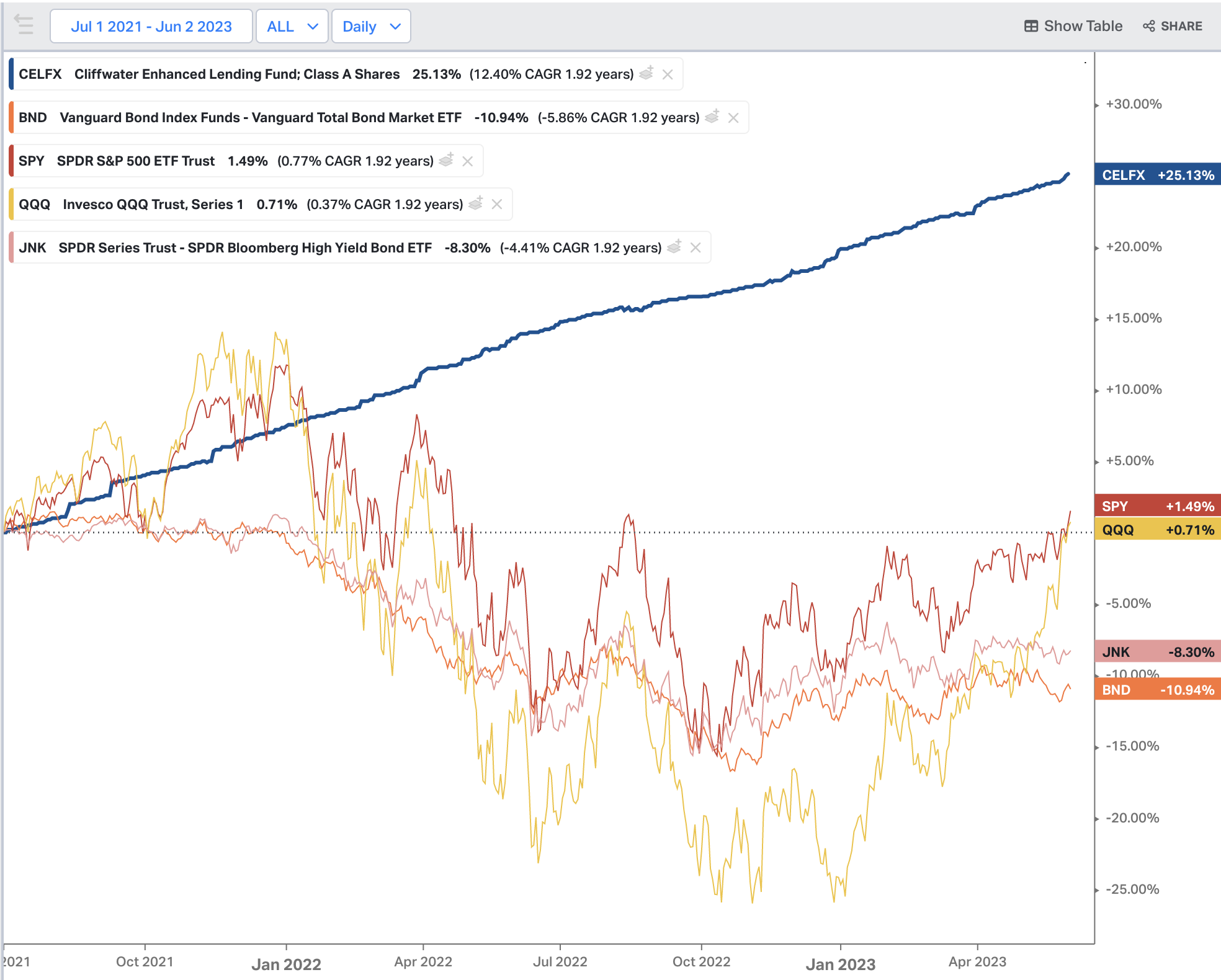

Compare the performance of Private Debt to traditional Stocks and Bonds:

Our value-add is transparent.

- Enhanced Returns: Private Debt has historically outperformed public Bonds by +6.3% annually (source)2 over the last 19 years (source). Private Debt is expected to outperform public Bonds by +6.4% annually for the next 10 years (source). At a 40% portfolio allocation, this adds 2.5% to gross return at the portfolio level. Deducting out highest fee rate of 1.0%, clients will net a 1.5% outperformance annually. Larger portfolios of $1M+ will see a greater net return due to lower fee rates.

- Reduced Volatility: In March 2020, during COVID, when most Stock indexes were down 30%-35% or more, our two preferred Private Debt funds were down only 3-4%1. By complementing your stocks/equities with private debt funds, you can expect to lower your portfolio volatility while still matching long-term equity returns. Speak with us on how this complementing nature enables portfolio rebalancing to further increase portfolio returns by +0.45% annually over a full 10-year market cycle (Source).

- Lower Fees: Paragon offers lower advisory fees, for example our 0.45% annual fee for 'Access Only' on a $5.0M portfolio, compared to the 1.0% industry's average fee for a retail investment advisor3.

*As of 03/31/2023.

** +1.50% increased net return at the portfolio level assumes a 6.3% outperformance within a 40% portfolio allocation to Private Debt instead of public Bonds (+6.3% * 40% = +2.5% at portfolio level). Then we deduct our maximum fee rate of 1.0% annually to arrive at the stated +1.5% net outperformance at the portfolio level. Larger portfolios would have a lower fee rate and thus a greater net outperformance.

Better Performance Through Independent Research, Due Diligence, and Exclusive Access.

Private Debt Is The All-Weather Asset Class

In 2022, when nearly all Stock and Bond indexes were down by -15 to -25%, our preferred Private Debt funds were largely unaffected, with the largest drawdown being -0.5% in 2022. The beauty about Private Debt is that there's only one thing that has negative impact on it: corporate defaults. And it turns out that not going bankrupt is a pretty low bar, even during recessions and bear markets such as 2022 and early 2020. Even in the case of a default, recovery rates average 65%+, meaning if we had a severe recession and corporate defaults reached 6%, you'd still only see a realized loss of -2%. Due to its resiliency during recessions and bear markets, Private Debt has been coined the "All-Weather Asset Class".

Original Source: Koyfin.com, retrieved 6/2/2023.

GDP Growth, Revenue Growth, & Earnings Growth Not Required

In order for Stocks & Equities to appreciate in value, the underlying companies need to grow profits and/or revenues (with the expectation of future profits). For Private Debt, that factors largely don't matter. If a company's profits decline by 50%, that stock is likely to tank 50%. But even though that company is less profitable, it can still pay the interest due on its loans, and the Private Debt funds with exposure to the same company keep making their 9-10% annually.

Compare the performance of Private Debt to traditional Stocks and Bonds:

1. Return Assumptions & Disclosures for Paragon Investing.

2. Private Debt Illiquidity Yield Premium: Disclosures & Assumptions.

3. Paragon's lowest published advisor fee of 0.45% is 55% lower than the industry-average retail advisor fee of 1.00% (as of 2018):

PriceMetrix by McKinsey: State of Retail Wealth Management, 8th Annual Report, 2018

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. Please see our Full Disclosure for important details.

Copyright © Paragon Investing. All Rights Reserved. Privacy Policy. Terms of Use. Form ADV and Supplement. RIA and IAR Registration.